All Categories

Featured

Table of Contents

On the other hand, if a client requires to offer a special needs child who might not have the ability to manage their very own money, a depend on can be included as a recipient, permitting the trustee to manage the distributions. The sort of beneficiary an annuity proprietor picks impacts what the recipient can do with their inherited annuity and how the proceeds will certainly be tired.

Lots of agreements allow a partner to identify what to do with the annuity after the proprietor dies. A spouse can change the annuity agreement into their name, presuming all guidelines and civil liberties to the preliminary agreement and postponing instant tax obligation consequences (Fixed vs variable annuities). They can collect all staying settlements and any survivor benefit and select beneficiaries

When a partner ends up being the annuitant, the spouse takes over the stream of payments. This is called a spousal continuation. This clause enables the enduring spouse to keep a tax-deferred standing and safe lasting financial security. Joint and survivor annuities likewise allow a called beneficiary to take over the contract in a stream of repayments, as opposed to a lump amount.

A non-spouse can only access the assigned funds from the annuity owner's initial contract. In estate preparation, a "non-designated beneficiary" refers to a non-person entity that can still be named a recipient. These consist of trust funds, charities and other organizations. Annuity owners can select to assign a trust fund as their recipient.

What types of Long-term Care Annuities are available?

These differences designate which recipient will receive the whole survivor benefit. If the annuity proprietor or annuitant dies and the primary beneficiary is still active, the primary beneficiary obtains the survivor benefit. If the primary recipient predeceases the annuity owner or annuitant, the fatality benefit will certainly go to the contingent annuitant when the proprietor or annuitant dies.

The owner can alter beneficiaries any time, as long as the agreement does not call for an irrevocable recipient to be named. According to expert contributor, Aamir M. Chalisa, "it is necessary to understand the value of assigning a beneficiary, as selecting the wrong beneficiary can have serious effects. Much of our customers select to call their minor youngsters as recipients, frequently as the main recipients in the lack of a partner.

Owners that are wed ought to not think their annuity instantly passes to their spouse. When picking a beneficiary, think about factors such as your connection with the individual, their age and exactly how inheriting your annuity could influence their financial situation.

The recipient's partnership to the annuitant normally figures out the policies they adhere to. For example, a spousal beneficiary has more options for managing an inherited annuity and is treated more leniently with taxation than a non-spouse recipient, such as a youngster or other member of the family. Annuity withdrawal options. Suppose the proprietor does determine to call a child or grandchild as a recipient to their annuity

What is included in an Annuity Contracts contract?

In estate preparation, a per stirpes designation specifies that, needs to your beneficiary die before you do, the recipient's offspring (children, grandchildren, et cetera) will get the survivor benefit. Get in touch with an annuity expert. After you've chosen and named your recipient or recipients, you need to proceed to review your choices at the very least annually.

Keeping your designations up to date can guarantee that your annuity will certainly be managed according to your wishes must you pass away unexpectedly. An annual evaluation, significant life events can prompt annuity proprietors to take an additional look at their recipient choices.

Who offers flexible Lifetime Income Annuities policies?

As with any kind of monetary item, seeking the help of an economic consultant can be beneficial. A financial organizer can direct you via annuity management procedures, consisting of the methods for upgrading your contract's recipient. If no recipient is called, the payout of an annuity's survivor benefit mosts likely to the estate of the annuity owner.

To make Wealthtender cost-free for visitors, we earn cash from marketers, including financial experts and companies that pay to be featured. This creates a problem of rate of interest when we favor their promotion over others. Wealthtender is not a customer of these financial services suppliers.

As an author, it is just one of the very best compliments you can offer me. And though I actually value any one of you spending several of your busy days reviewing what I write, slapping for my write-up, and/or leaving praise in a comment, asking me to cover a topic for you truly makes my day.

It's you claiming you trust me to cover a subject that is necessary for you, and that you're certain I 'd do so better than what you can already locate on the internet. Pretty spirituous stuff, and a responsibility I don't take likely. If I'm not familiar with the subject, I research it online and/or with get in touches with that recognize more regarding it than I do.

Lifetime Payout Annuities

In my buddy's situation, she was thinking it would be an insurance coverage of sorts if she ever goes right into taking care of home treatment. Can you cover annuities in an article?" Are annuities a legitimate suggestion, an intelligent move to protect surefire income for life? Or are they an unethical advisor's way of fleecing innocent clients by encouraging them to move properties from their portfolio into a complex insurance coverage product pestered by excessive fees? In the easiest terms, an annuity is an insurance item (that only certified agents might offer) that ensures you month-to-month settlements.

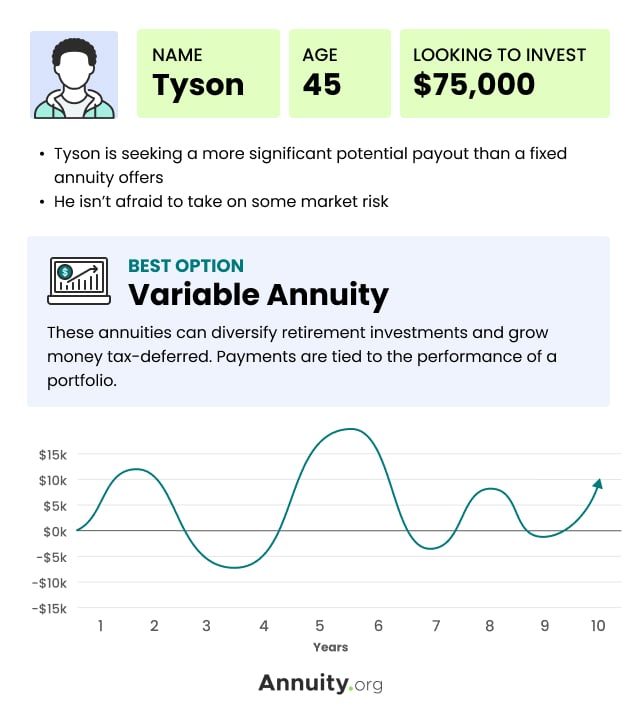

This typically applies to variable annuities. The more motorcyclists you tack on, and the less risk you're ready to take, the lower the settlements you ought to expect to get for a provided costs.

How do I get started with an Annuity Contracts?

Annuities picked properly are the appropriate selection for some people in some circumstances. The only way to understand for sure if that includes you is to first have a detailed financial plan, and afterwards determine if any type of annuity alternative supplies enough advantages to justify the costs. These costs consist of the bucks you pay in costs of program, but also the possibility cost of not spending those funds in a different way and, for a number of us, the impact on your ultimate estate.

Charles Schwab has a clever annuity calculator that reveals you around what repayments you can get out of dealt with annuities. I made use of the calculator on 5/26/2022 to see what an immediate annuity may payment for a single costs of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros And Cons Why Choosing the Right Fi

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Advantages and Disadvantages of Fixed Indexed Annuity Vs Market-variable A

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement

More

Latest Posts