All Categories

Featured

Table of Contents

: Annuities can use surefire income for life. Annuities do not. Since they're spent differently, annuities typically provide a greater ensured rate than various other items.

You pay taxes when you obtain your annuity revenue, and no one can predict what the taxed rate will certainly be at the time. Annuities can be tough to understand.

Annuity Withdrawal Options

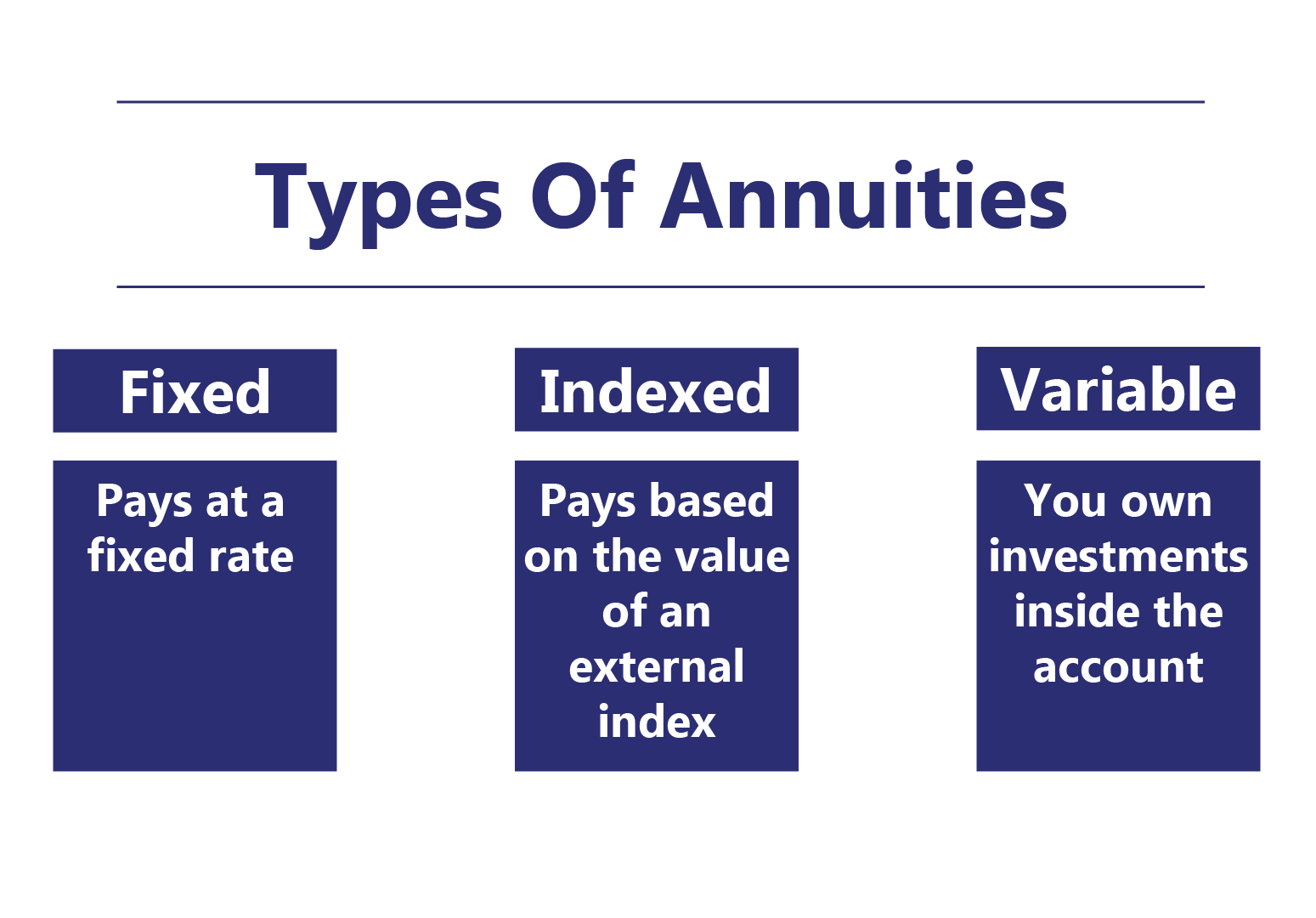

Down payments right into annuity contracts are commonly secured for a time period, where the annuitant would certainly sustain a charge if all or part of that money were withdrawn. Each sort of annuity has its own one-of-a-kind advantages. Identifying which one is appropriate for you will depend upon elements like your age, danger resistance and just how much you need to invest.

This product is a mix of its repaired and variable loved ones, and that makes it a bit more difficult. The passion rate paid to annuitant is based upon the performance of a defined market index. With an indexed annuity, you have the chance to gain greater returns than you would with a taken care of annuity with more protection against losses than with a variable annuity.

How long does an Lifetime Payout Annuities payout last?

An annuity is an agreement with an insurance provider that supplies tax-deferred passion and the possibility for an assured stream of income. Buying one can help you really feel a sense of monetary protection in retirement - Annuities. There are additionally a number of various other benefits to consider. One benefit to annuities is the fact that they can offer surefire earnings for an established number of years, and even for the rest of your life.

In these circumstances, you can think of an annuity as insurance policy against possibly outliving your financial savings. For employees who do not obtain a pension plan, an annuity can help load that void. Employees can spend cash right into a pension (like an IRA) and then, upon retired life, take those cost savings and acquire an annuity to supplement Social Security.

Guaranteed Income Annuities

An additional huge advantage provided by annuities? The money you contribute grows tax-deferred. This suggests you do not pay tax obligations on the passion until you start obtaining the funds, commonly after you begin retirement. All certified annuity withdrawals go through ordinary revenue tax obligation, and withdrawals taken prior to the age of 59 will incur an extra 10% tax fine The tax-deferred standing can allow your money to have even more growth potential or allow your money to possibly grow even more gradually since earned interest can compound with no funds needing to approach tax obligation repayments.

Unlike other retired life options, there are no internal revenue service limitations on the amount of cash you can add to an annuity. The IRS areas caps on the quantity you can buy an individual retirement account or 401(k) each year. The 2024 limitation for an IRA is $7,000 a year or $8,000 if you're 50 or over.

How do I receive payments from an Annuity Riders?

1 Yet the Internal revenue service does not place a ceiling on the amount you can add to an annuity.

What this implies is you can either purchase an annuity that offers settlement within a year of your premium or an annuity that begins paying you in the future, commonly upon retirement.

Biker benefits, terms and conditions will differ from rider to biker. Lasting treatment insurance policy can be expensive or difficult to obtain for those with pre-existing problems or health and wellness issues. This is a location where annuity benefits can use owners an advantage. With an annuity, you might have an option to purchase a motorcyclist that permits you to obtain higher payments for an established period if you call for lasting treatment.

It's just an assured amount of earnings you'll receive when the annuity enters the payment phase, based upon the claims-paying capacity of the insurance provider. With any kind of monetary decision, it's excellent to know and consider the expenses and benefits. If you would like to know what are the advantages of an annuity, remember it's a feasible alternative to conserve tax-deferred cash for retirement in such a way that matches your demands.

What is the difference between an Annuities For Retirement Planning and other retirement accounts?

Lots of people choose to begin receiving these payments either at or sometime after retirement - Guaranteed return annuities. Annuities have a whole host of names, based upon benefits and releasing companies, however at their core, they are best recognized by their timeline (prompt or delayed) and whether they include market direct exposure (variable). A prompt annuity lets you right away transform a lump amount of money into a guaranteed stream of revenue.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros And Cons Why Choosing the Right Fi

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Advantages and Disadvantages of Fixed Indexed Annuity Vs Market-variable A

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement

More

Latest Posts